The race for a cashless society and the launch of the first digital currency

The trend to replace physical money with other forms of payments that do not involve notes or coins was felt long before the pandemic, and has only accelerated since in every part of the globe. The so-called cashless society was installed for good.

Contactless cards and payments via smartphone have been growing rapidly since 2020 and most people choose to make physical purchases without cash, along with spending more on online purchases.

The survey “Contactless Payments: Trends, Opportunities and Market Forecasts 2021-2026” conducted by Jupiter Research found that the combination of accelerated card issuance, the increased usage during the pandemic, and rising global adoption, unlocked a new potential for growth in cashless payments, fundamentally changing the payment paradigm.

This report pointed out that global contactless card transaction values will increase to US$2.5 trillion in 2021, from US$1.7 trillion in 2020. The pandemic significantly accelerated an existing trend towards contactless card use, which is expected to reach 79% in 2021.

Research author Susannah Hampton said, “Markets like Germany have seen an unprecedented shift towards contactless cards over the past 18 months. This shift has dramatically diminished the role of cash and created significant opportunities for card issuers to gain market share “.

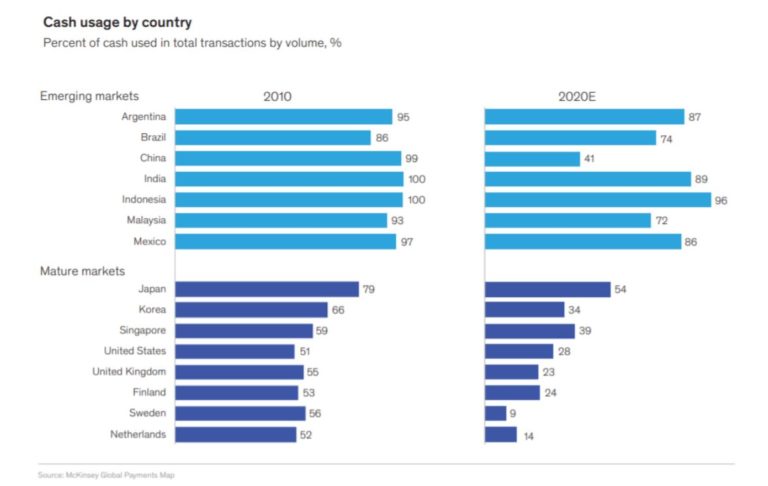

Sweden, among seven other “mature” markets included in McKinsey’s Global Payments Report study, leads the way in using the least cash. The of banknotes and coins is slowing down and, last year, only 9% of payments made by Swedes were in cash.

Digital alternatives to cash and credit cards are also at the forefront of new forms of contactless payment. Wallets and wearables such as Google Pay and Apple Pay for C2B (consumer to business) payments for physical or digital goods, and even for P2P (person to person) payments are growing in the market. Due to lifestyle changes, daily commerce and the rapid growth of online retailing, this trend is expected to continue.

The launch of the first digital currency

Sweden, the world’s least cash-using economy, announced its pioneering project in 2017 to digitize the national currency, and in February 2020 the Riksbank (Swedish Central Bank) saw potential problems arise from the cash decline and began running a project to investigate the possibility of producing a digital complement to their money, which we call e-krona. It kicks off the test of the world’s first digital currency for a central bank. Despite being part of the European Union, Sweden did not join the euro and kept its national currency, the krona.

In April 2021, the year that marks its 353rd anniversary, the Riksbank published the results of the first phase of the e-krona project – which is considered the most advanced plan underway among major Western economies for the adoption of a digital national currency.

In this report, the central bank says that this first phase of the e-krona pilot project resulted in the initial construction of a network based on the R3’s Corda blockchain platform. The project shows that it would be possible to apply interest rates to a digital currency issued by a central bank – a CBDC (Central Bank Digital Currency).

The institution’s tone is optimistic, but the message is that there are still obstacles to be overcome: the current pilot project should only be completed in early 2022 – and there is the possibility that the tests will be completed only by 2026. This delay is due to the fact that such a project has never been carried out before and requires a lot of technical, political and legal efforts.

The Riksbank is now moving towards the second phase of testing the e-krona, which will involve a larger number of participants and will include potential CBDC distributors. The new phase will also test offline e-krona functionality and integration with existing point of sale terminals.

The goal of this project is to show that an e-krona can be used by institutions and the general public, as a kind of digital banknote – and in a way “as easy as sending a text message”.

Share on Facebook

Share on LinkedIn

Twitter

Share by email